WANT TO BUY MY BUSINESS PREMISES IN MY SMSF

Investing in commercial property via your SMSF or purchasing an owner occupied commercial property, or buying your business premises in your SMSF can be one of the most beneficial strategies.

WHAT CAN I INVEST IN AND WHO CAN INVEST

You can invest as an individual or as an owner occupied SMSF investor to purchase a commercial CBD office suite, for medical practices, small businesses, legal practices or a farm or a warehouse style property. Typically, where bank and non bank lending is concerned, the type of business real property, lenders will lend to, will determine the following factors.

- The level of lending or the loan to value ratio ( LVR) 55%-70%

- The term of the loan 15 -30 years

- The interest charged on the loan 5.99% - 9%

It is advisable to seek specialist advice on these matters so that you don’t run into problems with funding when purchasing your commercial property in an SMSF (super).

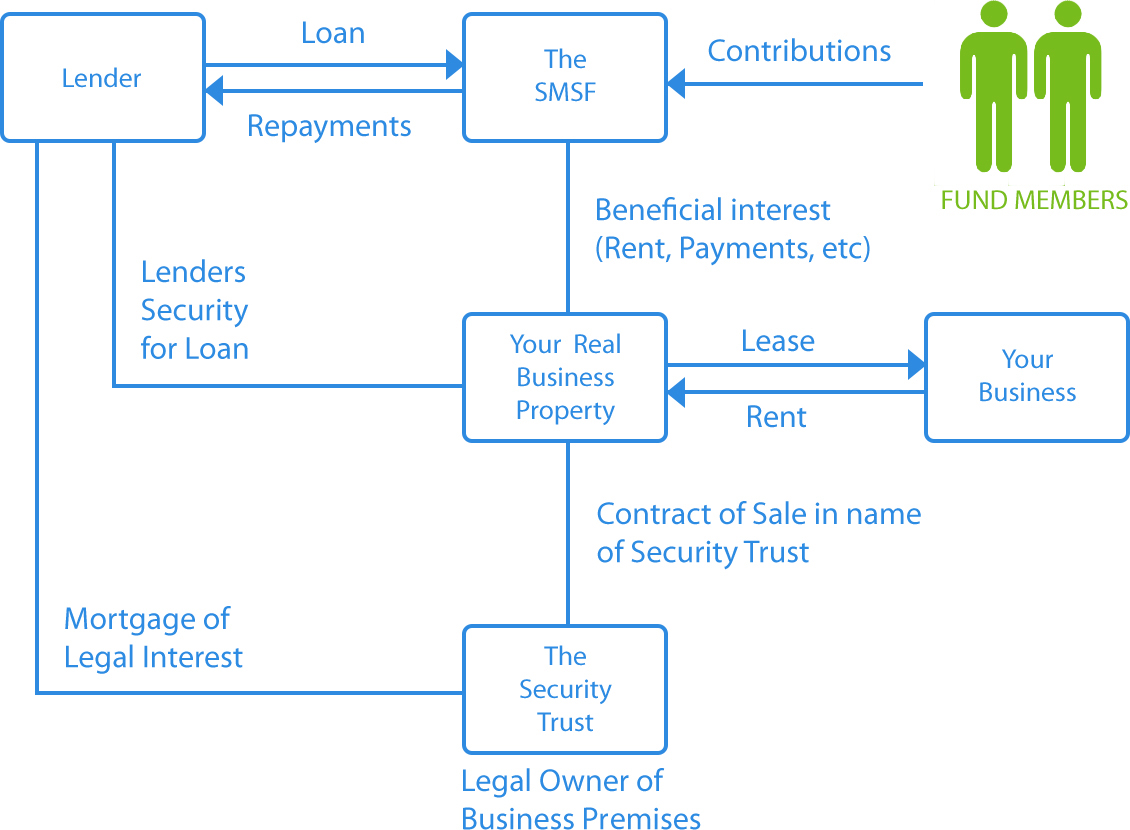

CAN MY SMSF PURCHASE MY EXISTING BUSINESS PREMISE AND RENT IT OUT

This would have to be the most popular form of SMSF commercial property purchase, due to the higher commercial rental returns and the retirement and business benefits gained from purchasing an owner occupied business property. Business Real Property is the only exception to the ATO rules for transferring property assets into an SMSF. It is also a highly beneficial strategy for owner occupied business owners for the following reasons.

- You are able to purchase your business premise and pay rent to your SMSF to own an asset for retirement.

- Given the super contribution restrictions of $25,000 per person( proposed), taxed at 15%,often commercial rents are well over $30,000 per annum, so in affect you are paying tax at 15% and contributing more money into your super fund than the allowable limit, to own an asset for your retirement, with the ability to still contribute up to $25,000 per person, with a further deduction available to selfemployed people. This generous exemption is one that more and more small business owners are taking advantage of.

- As business owners, buying your commercial space in your SMSF can avoid large capital expenses in purchasing commercial property and it can offer rental stability to the business by controlling leasing of the property without fear of a landlord evicting you.

ISSUES WITH THIS STRATEGY

It is very important that your SMSF commercial property is purchased at market value and that you rent the property at a market rental rate which is neither over market rates or under, so that you do not provide a benefit to your SMSF by charging it less for rent or by paying more rent to contribute more into super. You will need to ensure that you have a legal and enforceable lease is in place to document this arrangement as well.

Failure to do any of the above will render your fund non compliant by the ATO, resulting in penalty tax of 47% and fines and further action. One final point to consider is the risk of investing all of your super retirement savings in one asset (referred to as: concentration risk) and the very real risk of commercial property falling in value. In fact, such is the concern of falling commercial property values, that all bank lenders require regular valuations of commercial property to manage their risks.

There are other considerations when transferring business property to an SMSF, such as capital gains tax and stamp duty costs and the viability of this strategy based on the super funds trust deed and investment strategy. The good news is there are further tax exemptions for business owners and investment strategies can be varied, so it is always important to seek financial and tax advice with property in super strategies.

FURTHER READING

- SMSFR 2008/D3

- Sections 66, 67a, 67b, 71 and 109 of the SIS Act ( Super Laws )

SERVICE FEES

- SMSF commercial property administration $1,550

- SMSF Commercial lending - $550

- SMSF Commercial Property Advice and Conveyance

Tip: SMSF commercial lending takes double the time of residential lending so an extended settlement might be required.

1 MEMBER

AVERAGE RETAIL / INDUSTRY FUND SUPER FEE*

Based on $100 000 balance1.21% = $ 1,210

* Report: Apra average super statistics Dec 2015Great Value

1-4 MEMBER

MYSMSF

SMSF Admin + Education & Support

$ 1,100

Annual Fee *

* excludes investment, regulator and ad hoc fees